By Na’ankwat Dariem | Last updated Sep 29, 2023

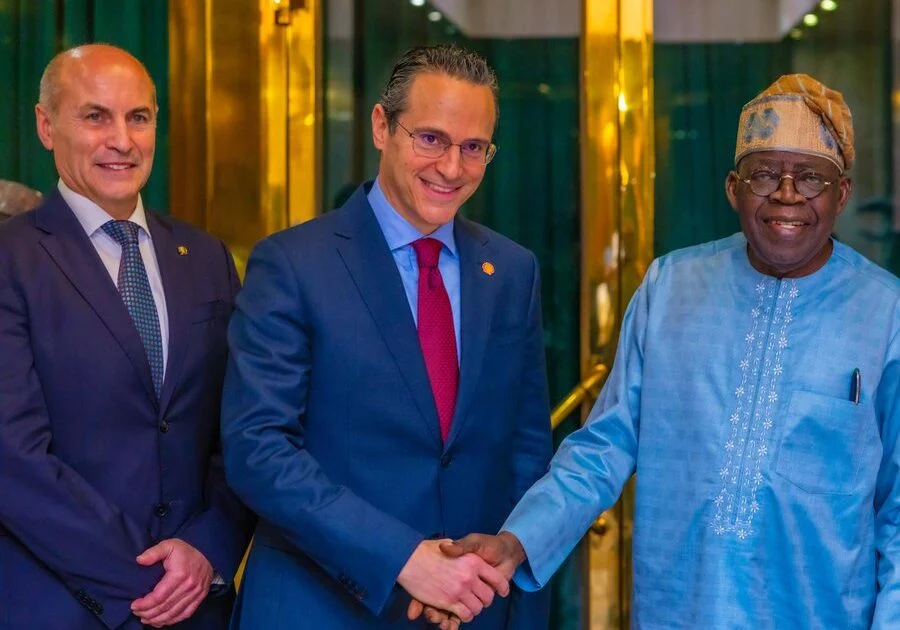

ABUJA, NIGERIA – The Minister of Communications, Innovation, and Digital Economy, Dr. Bosun Tijani, emphasized the importance of financial inclusion in eradicating poverty, fostering entrepreneurship, and promoting economic growth in Nigeria. Dr. Tijani made these remarks at the launch event of the Kayi Bank App, a groundbreaking fintech solution dedicated to providing secure, efficient, and customer-centric financial services.

The program, titled “Unlocking a Digital Finance Revolution,” took place in the capital city of Abuja.

According to Dr. Tijani, financial inclusion plays a significant role in driving economic growth by increasing the number of individuals and businesses participating in the formal economy. He pointed out that many Nigerian entrepreneurs, although highly entrepreneurial, are currently excluded from the formal economy. By providing them with access to financial services, the government can promote strong and inclusive economic growth that ultimately reduces poverty.

“Financial inclusion is the key to bringing more people into our economy,” Dr. Tijani stated. “By doing so, we have the opportunity to alleviate poverty and foster entrepreneurship, which are vital for our country’s progress.”

He further highlighted the importance of financial inclusion in the agriculture sector, which contributes significantly to Nigeria’s Gross Domestic Product (GDP). Access to resources and financial services can help farmers manage their income, sales, and obtain credit for their operations.

Moreover, Dr. Tijani urged investors to recognize the potential for profit at the bottom of the pyramid. By supporting financial inclusion initiatives, they can tap into vast untapped markets and contribute to the growth of the economy.

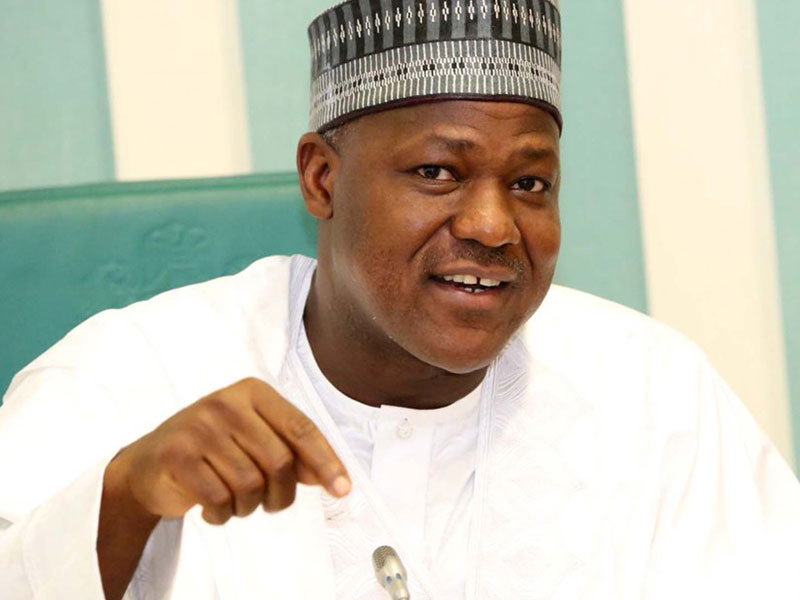

During the event, the Managing Director of Kayi Bank, Yunusa Mohammad, emphasized the app’s core features and capabilities, which aim to reshape financial transactions, enhance accessibility, and empower users to take control of their financial future.

“We are entering an era where financial transactions are simplified, accessible to all, and empowering,” Mohammad stated. “The Kayi app will revolutionize the way people engage with their finances.”

In his goodwill message, the Director-General of the National Information Technology Development Agency (NITDA), Mr. Kashifu Inuwa, highlighted the significance of this initiative in institutionalizing investment in Nigerian startups.

“Kayi Bank represents an opportunity to foster job creation and empower our people to build the next generation of digital banks,” Inuwa stated.

The launch event of the Kayi Bank App signifies Nigeria’s commitment to promoting financial inclusion, driving economic growth, and creating job opportunities. By embracing innovative fintech solutions, the country is taking substantial steps towards building a robust and inclusive digital economy.