The House of Representatives says it can probe the shortfalls in oil income in Nigeria.

It says the Budget Office has estimated over N2.7 trillion income loss in 2023.

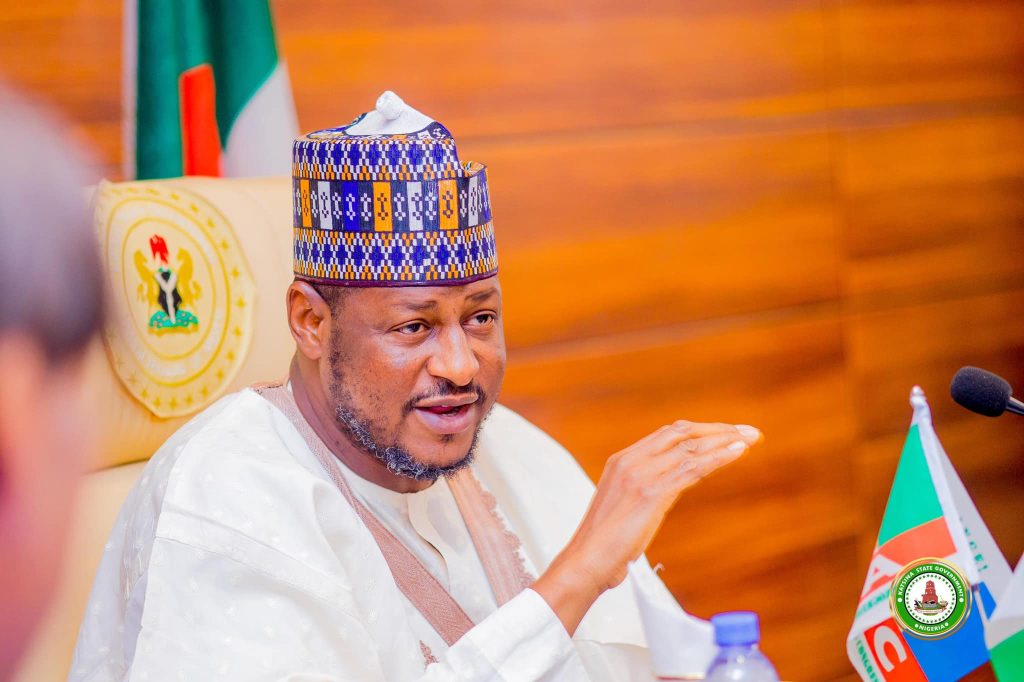

The chairman, House Committee on Finance, Hon. James Faleke, who made the disclosure through the 2023 Medium Term Expenditure Framework (MTEF) session by the home of Representatives with authorities companies, acknowledged that shortfalls in authorities income has resulted in deficit funds over time.

He defined that the shortfall has led to the federal government resorting to each home and international borrowing to implement its budgets.

“Our revenues have been lowering over time because of decreases in oil revenues which was our main earner. The Committee has vowed to get to backside of those oil shortfalls.

The NNPC, our oil asset managers, give oil theft as the primary trigger; nevertheless how are our marginal discipline operators performing vis a vis the assorted oil fields potentials?

“How a lot deductions at supply from oil productions are occurring because of NNPC signed agreements over time that at the moment are impacting on our revenues?

Even within the gentle of those income shortfalls, the Federal Government continues to be dropping income from varied waivers and exemptions granted varied organisations.

“In 2024 the Budget Office has estimated a loss in revenue of over N2.7 trillion. Is the Government getting the alternative benefits of these revenue losses? Is the Public getting value for money for these revenues foregone or is it just beneficial to a small set of well-connected people?” Hon Faleke mentioned.

The lawmaker lamented that “steady borrowing because of these funds deficits has ballooned our debt servicing funds to the unhappy state of affairs the place final 12 months we spent over 95% of our revenues on debt servicing.

He famous that the parliament would make sure that the federal government will get worth for cash, in all agreements”.

He mentioned, “The committee wouldn’t settle for laxity on the a part of MDAs saddled with the accountability of negotiating on behalf of the federal government.

“The Committee has noticed varied components which have induced shortfalls in anticipated revenues in addition to costs to Government revenues from commitments by companies of Government.

The Committee won’t settle for such laxity on the a part of MDAs in not negotiating one of the best for the Country. The $ 11 billion P & I D fiasco continues to be contemporary in our minds the place the entire Country was nearly held hostage to a fraudulent settlement.

“Another agreement signed on behalf of the Government by NBET and Azura Power has committed payments of over $30m per month. This agreement is dollar denominated and applicable even now in times of acute foreign exchange shortages.”

The Accountant General of the federation Mrs Oluwatoyin Madein, whereas responding to questions mentioned that income technology and assortment is dwindling as compared with the expenditures which are set towards the cash collected.

She acknowledged that collection of efforts are presently ongoing to shore-up revenues, plug the leakages and enhance on the revenues which are being introduced into the federation.

“In as much as the revenue would be in this position, the expenditures too has not also been helping matters, especially with the current economic reality, where prices of things are going up regularly”. She mentioned.

According to her, the methods to extend revenues should be labored upon on a steady foundation to make sure that there are funds to satisfy the expectations of Nigerians.

The Chief Executive Officer Ministry of Finance Incorporated (MOFI) Mr. Armstrong Katang, mentioned MOFI was designed to determine a federal authorities property register that gives feasibility over federal authorities funding property.

This he mentioned would make authorities to know what it owns and what it owes.

“That information allows us to better optimize our investment assets, allow us to track the revenues that those assets ought to be contributing and are contributing to our revenue”. He mentioned.

Other companies are anticipated to seem earlier than the committee because the session continues.

Olusola Akintonde