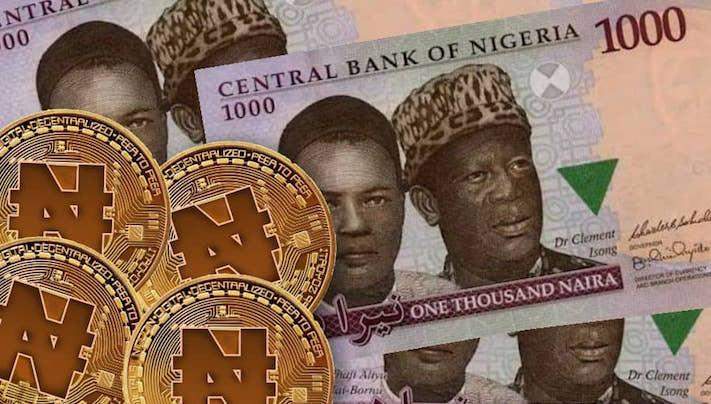

In a groundbreaking move, Nigerian financial institutions, fintech companies, a blockchain firm, and the Africa Stablecoin Consortium have disclosed their plans to unveil a Naira-backed stablecoin, named cNGN, on February 27, 2024. This innovative development aims to leverage blockchain technology to bridge the Nigerian Naira with the global market, thereby revolutionizing financial transactions.

The consortium’s announcement, made on a recent Friday, marks a significant step in the adoption of digital currencies within the Nigerian financial landscape. The cNGN stablecoin’s launch is intricately linked to the regulatory sandbox introduced by the Central Bank of Nigeria, signifying a harmonious synergy between traditional financial systems and cutting-edge blockchain technologies.

According to the consortium’s statement, the cNGN stablecoin is set to bring about a paradigm shift in financial fluidity. It is designed to be fully backed by Naira reserves held in designated commercial banks, adhering to a 1:1 ratio. This solid backing provides a foundation for the cNGN stablecoin to transform the Nigerian Naira into a dynamic tool for global remittances, commerce, trade, and investment, potentially reshaping the nation’s economic landscape.

This announcement comes on the heels of the Central Bank of Nigeria’s decision to lift the ban on cryptocurrency transactions in the country in December of the previous year. However, it’s worth noting that the CBN imposed limitations, including restrictions on cash withdrawals and the issuance of specific guidelines pertaining to cryptocurrency accounts.

The introduction of the cNGN stablecoin holds the promise of accelerating financial inclusivity, enhancing cross-border payment efficiency, and fostering a conducive environment for investment and trade. As the global financial landscape continues to evolve, the unveiling of the cNGN stablecoin stands as a testament to Nigeria’s progressive approach to harnessing the potential of digital assets in propelling economic growth and financial connectivity.