The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) has taken a firm stand against the proposed sale of Shell, the Nigerian onshore subsidiary of Shell Petroleum Development Company of Nigeria Limited (SPDC). The association’s rejection of the sale has ignited fears of a nationwide strike.

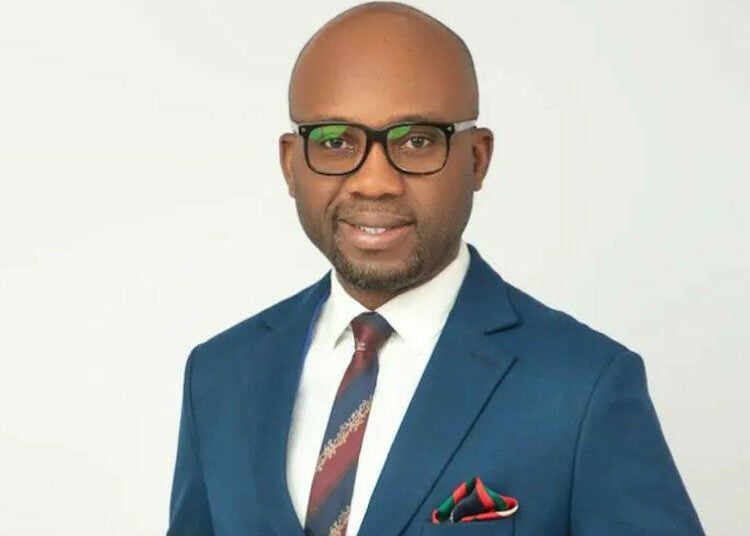

In a statement released by PENGASSAN’s General Secretary, Lumumba Okugbawa, the association expressed strong reservations about the potential sale. This development transpired shortly after Shell’s agreement to offload its onshore assets to Renaissance, a consortium comprised of five Nigerian companies and an international energy group, for a staggering sum of up to $2.4 billion.

PENGASSAN raised concerns about the lack of clarity surrounding the consortium poised to acquire SPDC, citing their obscure nature and a dearth of proven experience in managing such extensive assets. This skepticism has prompted PENGASSAN to issue a strike notice to its members nationwide.

The association strongly denounced the terms affecting employees that were communicated in the presentation to its members: “We reject without equivocation all the terms affecting employees that were communicated in the presentation to our members,” stated PENGASSAN.

PENGASSAN further underscored the contentious history of some of the entities within the consortium, condemning one for mistreating workers and subjecting them to hardship, and another for stifling the unionization of workers and impeding fair labor practices.

Expressing clear determination, PENGASSAN warned of resolute resistance to any attempt to transfer the assets without addressing the concerns of its members. The association urged the consortium to engage in earnest dialogue and not emulate what it perceives as the superficial engagement of the current Shell Management.

Furthermore, PENGASSAN communicated its directive to the Shell/SNBO branches, instructing them to remain focused on the imminent CBA negotiation. The association also put industry regulators, joint venture asset partners, and other stakeholders on notice, signaling a heightened state of vigilance in the face of the unfolding developments.

As the situation continues to evolve, the implications of PENGASSAN’s resolute stance against the sale of Shell loom large, posing significant challenges to the involved parties and potentially disrupting the oil and gas industry in Nigeria.