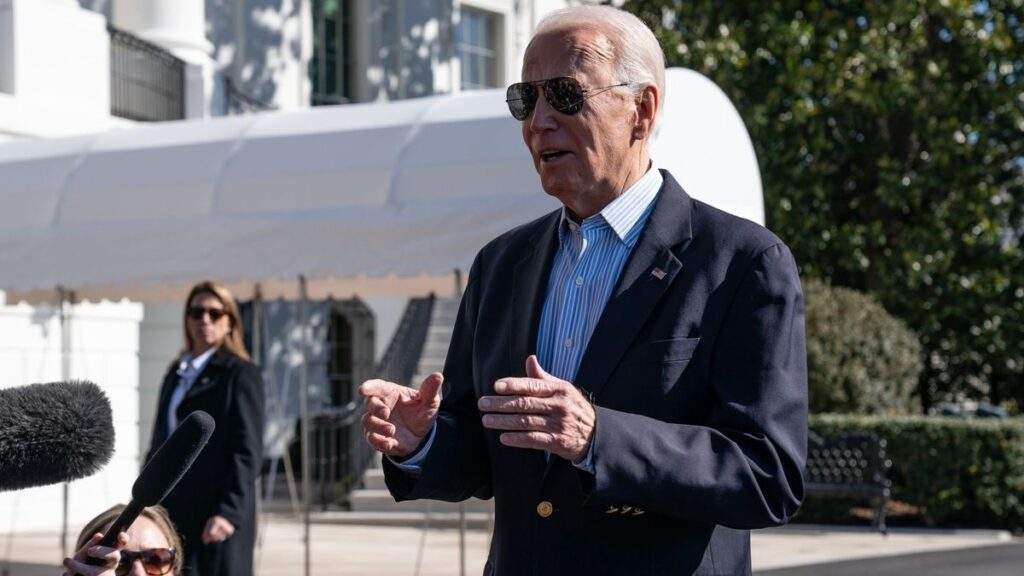

In a bold and unprecedented move to support Ukraine amidst ongoing conflict, President Joe Biden is spearheading efforts to rally the G-7 nations towards a groundbreaking plan. The focus is on utilizing frozen Russian sovereign assets as a lifeline for Ukraine, marking a significant shift in international economic strategies in the midst of war.

The proposal, initially championed by European Commission President Ursula von der Leyen, involves tapping into the interest generated by the Central Bank of Russia’s frozen 200 billion euros. While the United States and the United Kingdom stand firmly behind the idea, the European Union approaches the concept with caution. Concerns over the legality and potential consequences of seizing these assets create a divide among EU members, with some advocating for decisive action while others hesitate, weighing the geopolitical implications.

As the G-7 nations explore various options to support Ukraine without directly seizing the principal of the frozen assets, innovative approaches come to the forefront. Ideas such as using the assets as collateral for bond sales or providing market guarantees are being considered to navigate legal and ethical challenges. The potential involvement of the International Court of Justice in awarding compensation through seized assets adds another layer of complexity to the situation. Treasury Secretary Janet Yellen’s endorsement of unlocking Russian assets underscores the urgency of finding a practical solution before the upcoming June G-7 summit.

The decision to repurpose frozen Russian assets for Ukraine’s benefit could have far-reaching implications, reshaping international economic sanctions and asset seizure frameworks. By transforming these assets into a source of military and economic support for Ukraine, the G-7 nations could bolster Ukraine’s position while sending a strong message to Russia. However, this approach is not without risks, including potential retaliation and the establishment of precedents that could impact future international relations and financial systems.

The upcoming G-7 meeting in June holds immense significance for international diplomacy and economic policy. As countries weigh the potential benefits against the risks, the world watches with bated breath, anticipating a decision that could have a profound impact on the conflict in Ukraine and redefine global economic sanctions strategies.