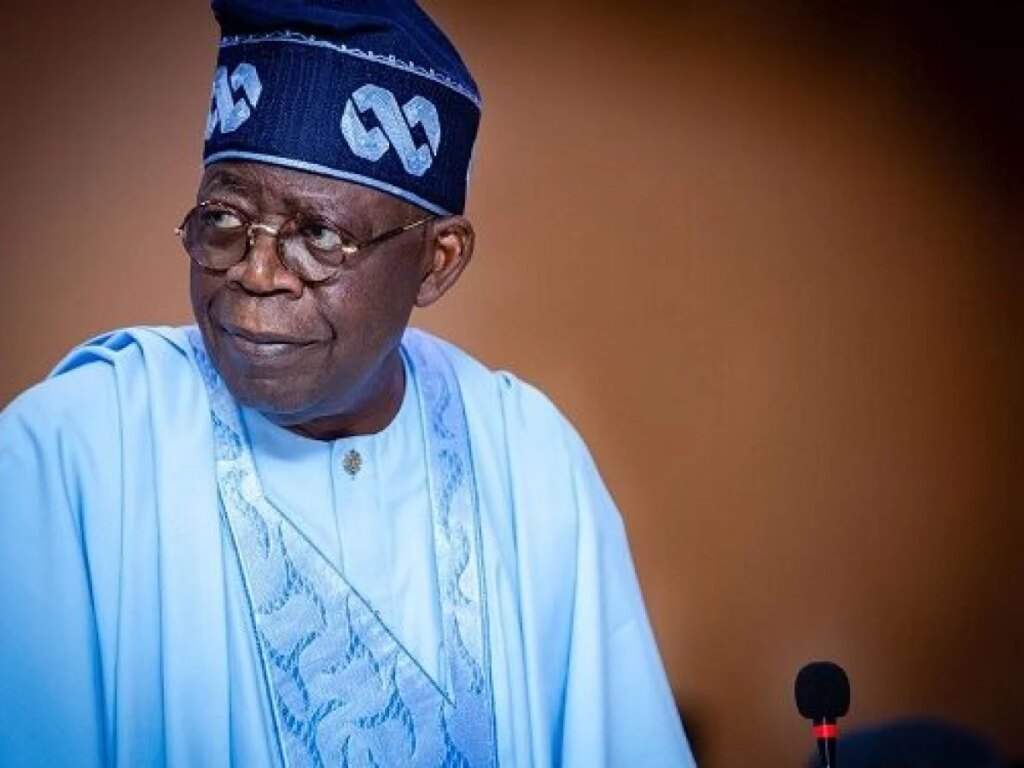

President Bola Ahmed Tinubu’s economic interventions have not eased the worsening economic hardship in Nigeria during the first half of 2024, according to economists and financial experts interviewed by DAILY POST.

Despite the government’s Renewed Hope Mantra, Tinubu, who marked his first anniversary in office on May 29, has struggled to provide Nigerians with tangible relief. The recent approval of N555 billion for 100,000 families, offering N50,000 payments for three months, has done little to stem the tide of economic distress.

In October 2023, Tinubu launched the ‘Conditional Cash Transfer’ under the now-suspended Minister of Humanitarian Affairs and Poverty Alleviation, Betta Edu. This scheme, supported by an $800 million World Bank loan, aimed to provide financial relief to struggling families.

Additionally, the government has approved zero tariffs, excise duties, and Value Added Tax on specialized machinery, equipment, and pharmaceutical raw materials to bolster local production of essential healthcare products. Further fiscal measures include a $3.3 billion crude oil-backed prepayment facility from Afreximbank and $2.5 billion World Bank loans to boost Nigeria’s foreign exchange supply. Efforts by the Presidential Tax and Fiscal Policy Committee to increase taxes are also underway.

However, these interventions have not mitigated the impact of inflation, with headline and food inflation rates rising to 33.95% and 40.66%, respectively, in May 2024. This has significantly eroded the purchasing power of Nigerians, exacerbating the misery index.

Nigeria’s debt burden has risen to N121.67 trillion as of March 2024. In the first quarter of 2024, the country spent $1.12 billion servicing foreign debt from N3.94 trillion in generated revenue. The Naira weakened to N1508.99 per dollar in the official market on Monday, amid several policies announced by the Central Bank of Nigeria, including the discontinuation of the Price Verification System Portal for importers.

Gbolade Idakolo, CEO of SD & D Capital Management, criticized Tinubu’s policies for failing to alleviate Nigerians’ hardships. He noted that welfare policies have not reached their intended beneficiaries due to high food inflation and the skyrocketing cost of living.

Muda Yusuf, director of the Centre for the Promotion of Private Enterprise (CPPE), acknowledged the government’s efforts but emphasized the need for more impactful policies. He urged the government to roll out more fiscal interventions in the agro-allied, construction, iron and steel, and mining sectors.

Prof. Godwin Oyedokun of Lead City University in Ibadan highlighted the significance of the N555 billion cash disbursement but warned that injecting such a large sum into the economy could exacerbate inflation if not accompanied by measures to increase supply and stabilize prices. He stressed the need for a holistic approach that combines short-term relief with long-term economic reforms to address the underlying issues causing inflation-induced hardship and achieve sustainable growth.