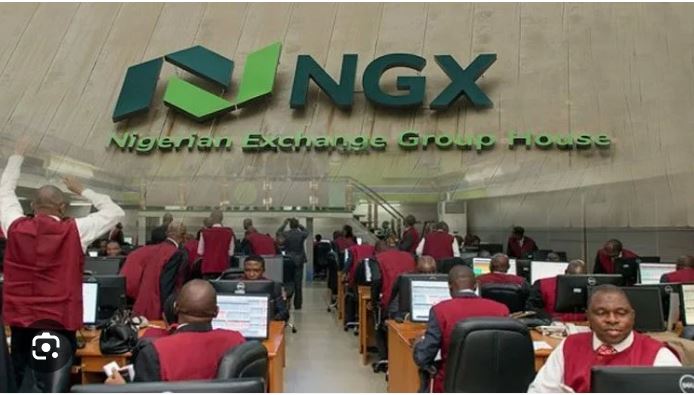

The Nigerian Exchange Ltd. (NGX) witnessed a significant rebound on Wednesday, putting an end to a four-day bearish trend with an impressive gain of N378 billion. This substantial increase is a testament to the market’s resilience and its ability to bounce back from adversity. The NGX market capitalization rose by 0.5% to close at N76.179 trillion, marking a notable improvement from the previous day’s N75.801 trillion.

The All-Share Index (ASI) also experienced a boost, increasing by 598.67 points or 0.5% to close at 120,339.90. This uptrend was largely driven by renewed investor interest in stocks such as Cileasing, Cutix, Ellah Lakes, International Energy Insurance, Omatek, and 56 others. The market breadth closed on a positive note, with 61 gainers and 16 losers, demonstrating a clear shift in investor sentiment.

Among the top performers, Cileasing and Cutix both saw a 10% increase in their share prices, closing at N5.06 and N3.96 per share, respectively. Ellah Lakes and International Energy Insurance also enjoyed a 10% rise, ending the session at N9.24 and N1.98 per share. Omatek Ventures similarly gained 10%, closing at 88k per share. On the other hand, Deap Capital, John Holt, Dangote Sugar, Universal Insurance, and Oando experienced declines, with drops ranging from 4.73% to 9.09%.

The total volume of shares traded on Wednesday was 1.05 billion, valued at N12.17 billion, spread across 21,964 transactions. This represents a significant increase from the previous day’s 527.1 million shares worth N11.28 billion, which were traded across 21,546 transactions. The activity chart was dominated by Royal Exchange, with 218.7 million shares valued at N229.11 million, followed closely by Ja Paul Gold and Ellah Lakes.

According to Mr. Aruna Kebira, Managing Director of Globalview Capital Ltd., the market’s current performance is a result of its maturity and the government’s reduced borrowing aggression. “Rates are tanking, and there is a capital flight into the stock market. Liquidity is what is driving the prices up,” he explained. Kebira further noted that the market is currently moving every stock, but this trend is expected to discriminate against poor performers once the Q2 2025 market results are released, ultimately leading to an equilibrium. The anticipation of interim dividends and increased capital market activities are also contributing to the current bullish run, as investors seek to capitalize on the market’s growth potential.