Nigeria’s headline inflation dropped again in June, falling to 22.22 per cent from 22.97 per cent recorded in May 2025.

This is according to the National Bureau of Statistics, NBS Consumer Price Index and Inflation Report for June, released on Wednesday.

Accordingly, the country’s headline inflation decreased by 0.75 per cent on a month-on-month basis.

Food inflation also declined to 21.97 per cent in June, down from 21.14 per cent recorded in the previous month.

Media Talk Africa reports that this marks the fifth consecutive decline in Nigeria’s inflation rate since the Consumer Price Index was rebased in January 2025.

However, despite the positive figures released by the NBS, the prices of goods and services have remained relatively high across Nigeria.

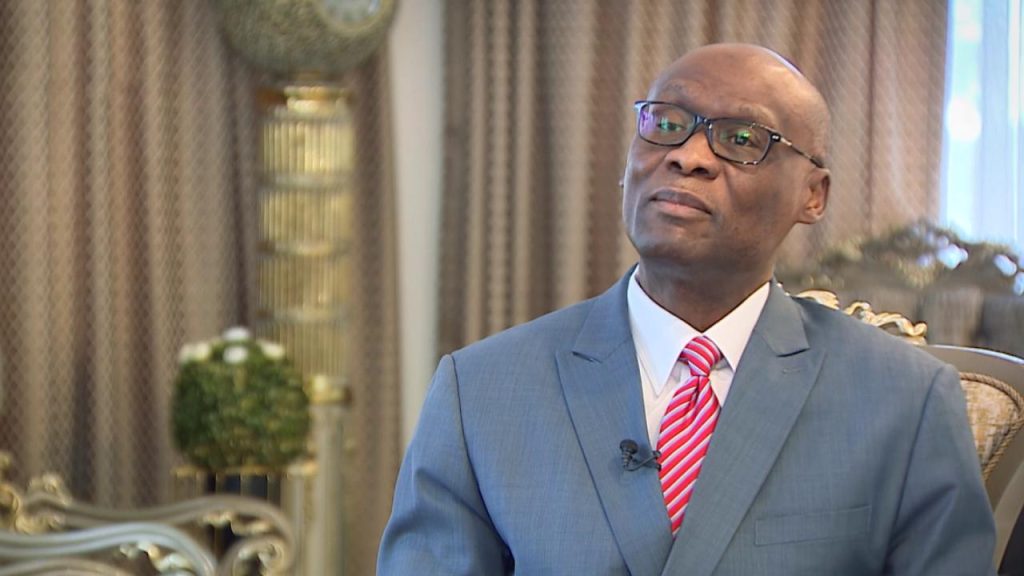

Economists and financial experts, including Okechukwu Unegbu, former President of the Chartered Institute of Bankers of Nigeria, have criticised what they describe as a disconnect between NBS data and lived reality.

“The general inflation is underreported, maybe due to political reasons,” he told Media Talk Africa.

Meanwhile, the Central Bank of Nigeria has announced that it will hold its 301st Monetary Policy Committee meeting on 21st and 22nd July to decide on Nigeria’s interest rate, which currently stands at 27.50 per cent.

Media Talk Africa also reports that inflation in the United States of America and the United Kingdom rose by 0.3 percent in June 2025, to 2.7 per cent and 3.6 per cent respectively.