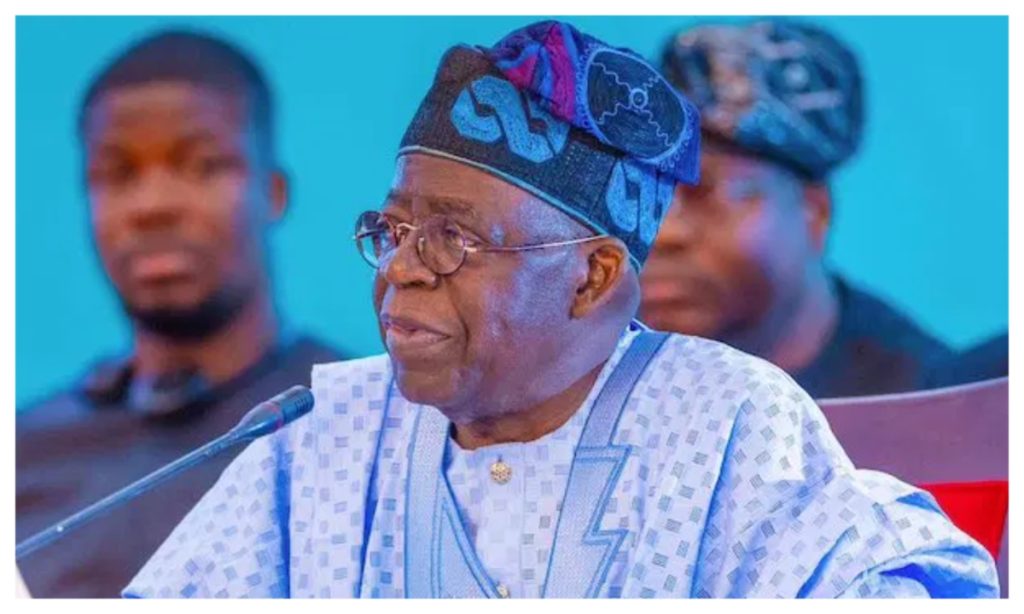

President Bola Tinubu has directed the Central Bank of Nigeria and other regulatory agencies to enhance their oversight of digital currencies in the country. This order was given at the 18th Annual Banking and Finance Conference of the Chartered Institute of Bankers of Nigeria, held in Abuja. Tinubu, represented by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, emphasized the need for closer regulatory attention due to the rapid adoption of digital payments outside the traditional banking system.

The President noted that many individuals are now using stablecoins and digital currencies for transactions, bypassing the conventional banking system. In response, he has instructed capital market and banking authorities to closely monitor and track the development of digital currencies. Tinubu also highlighted the importance of embracing digital tools, artificial intelligence, and open banking to drive economic growth.

CBN Governor Olayemi Cardoso projected that diaspora remittances could reach $1 billion monthly by next year, citing significant progress since the beginning of their efforts. Remittances have increased from $250 million to $600 million per month, with a target of $500 million previously set. Cardoso expressed optimism about achieving the new projection of $1 billion monthly by next year.

Prof. Pius Olanrewaju, President and Chairman of the Council of the Chartered Institute of Bankers of Nigeria, also addressed the conference. He mentioned that since 2024, 16 listed banks have raised over N2.5 trillion in fresh capital to strengthen their balance sheets. Additionally, net domestic credit to the private sector has risen to over N82 trillion this year, supporting businesses and job creation.

The increased focus on digital currencies and the growth of diaspora remittances underscore the Nigerian government’s efforts to adapt to evolving financial landscapes and promote economic development. By enhancing regulatory oversight and embracing digital technologies, the country aims to foster a more inclusive and resilient financial system. As the financial sector continues to evolve, the government’s initiatives are expected to play a crucial role in shaping the future of Nigeria’s economy.