The Federal Competition and Consumer Protection Commission (FCCPC) has announced a January 2026 deadline for full compliance with its Digital, Electronic, Online and Non-Traditional Consumer Lending Regulations, 2025. This move aims to promote fairness, transparency, and accountability in Nigeria’s rapidly growing digital lending market.

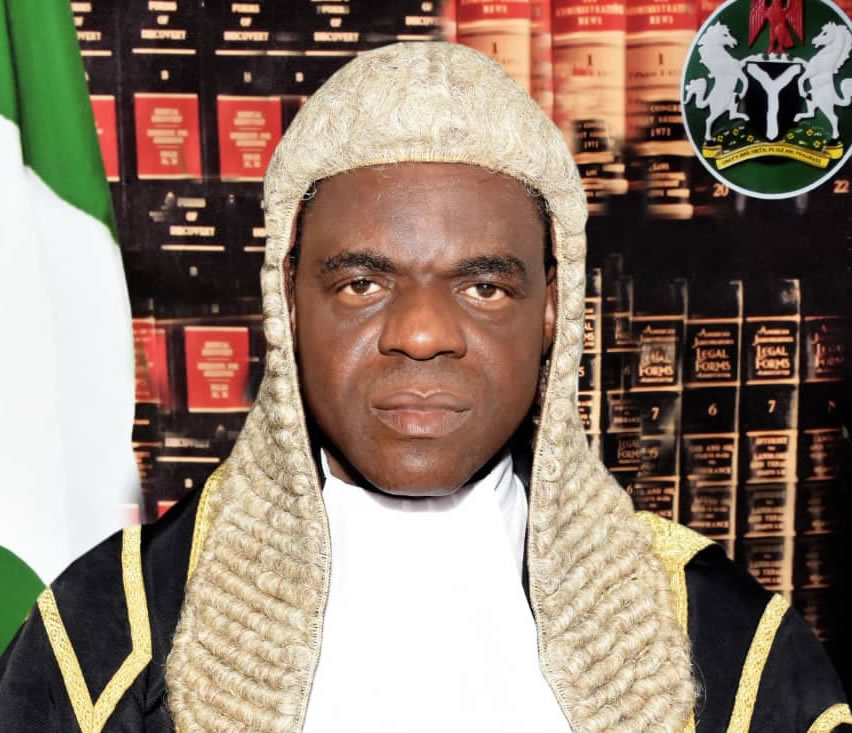

According to Ondaje Ijagwu, Director of Corporate Affairs at the Commission, the enforcement of these regulations will commence immediately after the deadline expires. Non-compliant entities may face sanctions, including operational restrictions, suspension of partnerships, and other penalties as permitted by law, as stated by the Executive Vice Chairman, Tunji Bello.

Mr. Bello emphasized that full compliance is both a legal requirement and a critical step towards protecting consumers while fostering responsible growth in the lending sector. He noted that operators have had sufficient time to adjust to the regulations and the additional guidance provided, and therefore, all obligations are expected to be met before the deadline.

To facilitate compliance, the commission has issued an additional instrument under Sections 17 and 163 of the FCCPA, offering practical guidance for lenders and intermediaries. This document outlines necessary documentation and introduces updated forms based on stakeholder feedback. All affected operators, including lending platforms, service partners, and intermediaries, must complete their compliance obligations by January 5, 2026.

The FCCPC’s commitment to promoting responsible digital lending practices is aimed at protecting consumers and strengthening confidence in Nigeria’s financial technology sector. By setting this deadline and providing guidance, the commission is taking a significant step towards regulating the digital lending market and ensuring that it operates in a fair and transparent manner.

This development is part of the commission’s broader efforts to regulate Nigeria’s digital economy and protect consumer rights. The digital lending market has experienced significant growth in recent years, with many consumers turning to online lenders for credit. However, this growth has also raised concerns about consumer protection and the need for regulation.

With the January 2026 deadline in place, digital lenders and other stakeholders must now take steps to ensure compliance with the regulations. This includes reviewing their operations, updating their documentation, and implementing necessary changes to meet the required standards. The FCCPC’s enforcement of these regulations is expected to have a significant impact on the digital lending market, promoting a more transparent and accountable industry that better serves the needs of consumers.