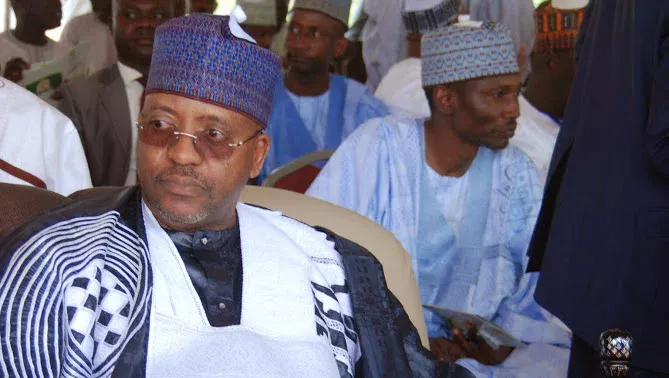

Nigeria’s Federal Government has moved to alleviate concerns surrounding the Capital Gains Tax (CGT) ahead of the country’s new tax laws taking effect on January 1, 2026. The assurance was given by Mr. Joseph Olasunkanmi Tegbe, Chairman of the National Tax Policy Implementation Committee (NTPIC), during the committee’s inauguration in Abuja.

The planned increase of the CGT to 30 percent, as stipulated in the amended Nigerian Tax Act, has sparked strong opposition from businesses and investors. In response, Tegbe pledged that the committee will address the concerns thoroughly, ensuring the implementation process is fair, responsible, and transparent. He emphasized that the committee aims to implement the tax laws with “a human face,” acknowledging the significant tasks ahead that are crucial to the country’s economic progress.

The CGT is a key concern that will be addressed in the coming days, according to Tegbe. He noted that the tax laws have far-reaching implications, affecting tax administration, federal and state-level interpretation, and the ease of doing business in Nigeria. The committee’s goal is to reassure Nigerians and investors that the implementation of the act will be fair, transparent, and without surprises.

The Nigerian government’s move to introduce new tax laws is part of its efforts to boost revenue and stimulate economic growth. The amended tax act aims to simplify tax administration, reduce tax evasion, and increase tax compliance. However, the proposed increase in CGT has raised concerns among investors and businesses, who argue that it could discourage investment and hinder economic growth.

As the committee begins its work, it will need to balance the government’s revenue needs with the concerns of investors and businesses. The outcome of the committee’s deliberations will be closely watched by stakeholders, as it will have significant implications for Nigeria’s economic landscape. With the new tax laws set to take effect in 2026, the committee’s efforts to address concerns and ensure a smooth implementation process will be crucial to the country’s economic progress.