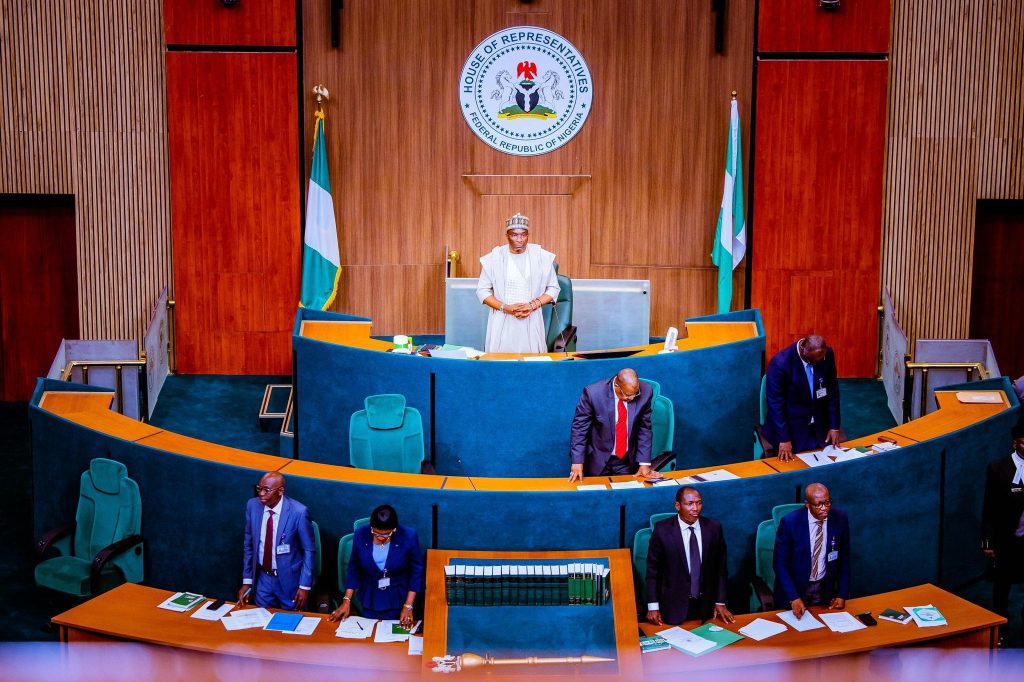

The Nigerian House of Representatives has urged the Federal Government to cancel outstanding COVID-19 survival loans granted to vulnerable households and small businesses. Lawmakers also advocated for the restructuring of the Small and Medium Enterprises (SME) component of the loan. This call was made following a motion presented by Hon. Musa Saidu Abdullahi from Niger State, which highlighted the challenges faced by beneficiaries in repaying the loans.

The COVID-19 Targeted Credit Facility was established by the Federal Government during the pandemic, with N419.42 billion disbursed to support affected households and small businesses. The program reached 792,936 beneficiaries, including 674,972 households and 117,964 small businesses, with women accounting for 45% of those supported. The loan program helped create or sustain approximately 1.58 million jobs during the pandemic. However, as of September 2023, N261.07 billion, or about 62% of the loans, remained unpaid, with a total of N378.03 billion outstanding.

According to Abdullahi, new surveys by the Central Bank of Nigeria (CBN) indicate that loan defaults are increasing due to high inflation, food insecurity, reduced income, and business closures. He argued that repayment has become unrealistic for many beneficiaries, emphasizing that the COVID-19 loan was intended as a survival support measure, not a regular business loan. Many households used the funds for essential expenses such as food, rent, healthcare, and school fees during the lockdown.

The lawmaker drew parallels with the Anchor Borrowers Programme, where loans were restructured or partly waived, and cited examples of countries like the United States, Canada, Germany, South Africa, and India, which waived parts of their COVID-19 relief loans in recognition of the unprecedented hardship caused by the pandemic. Abdullahi expressed concerns that continued automatic deductions are exacerbating the suffering of vulnerable Nigerians, risking the collapse of small businesses, increased unemployment, and social instability.

The House of Representatives has asked the Federal Government, the CBN, NIRSAL Microfinance Bank, and the Ministry of Finance to halt all deductions from beneficiaries’ accounts. The move aims to provide relief to struggling households and small businesses, acknowledging the significant challenges they face in repaying the loans. The decision underscores the need for a more nuanced approach to loan recovery, taking into account the extraordinary circumstances of the pandemic and its lingering impact on the economy.