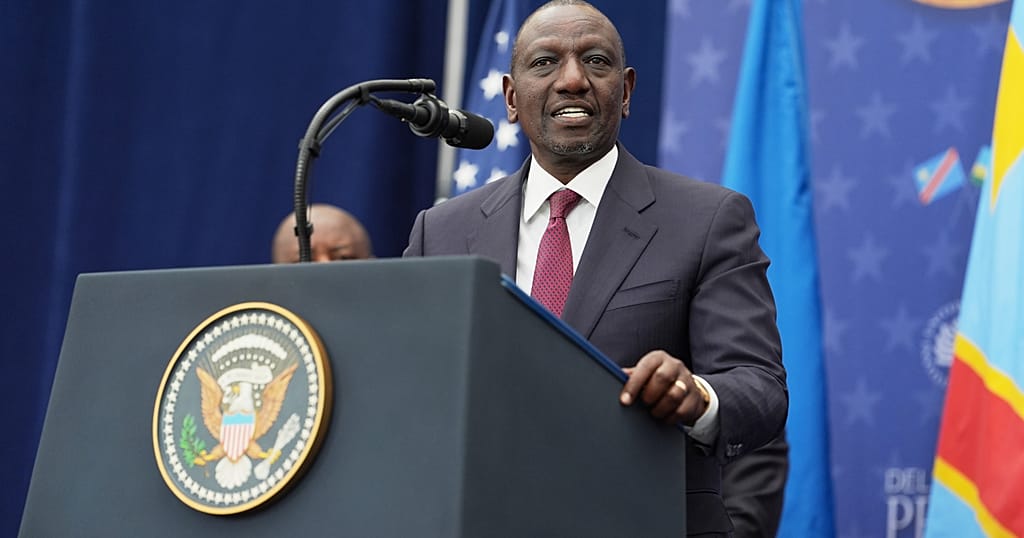

Kenyan President William Ruto has announced a significant restructuring of personal income tax thresholds, providing relief to millions of low- and middle-income earners as part of measures to alleviate cost-of-living pressures.

Under the proposed changes, individuals earning a monthly salary of 30,000 Kenyan shillings ($233) or less will be completely exempt from income tax. This threshold is a substantial increase from the current 24,000 shillings. For earners up to 50,000 shillings ($388) per month, the tax rate will be reduced to 25 per cent. President Ruto stated the plan would remove 1.5 million Kenyans from the tax register entirely and reduce liabilities for an additional 500,000 workers by 5 per cent.

The adjustment responds to sustained advocacy from the Kenya Bankers Association, which has argued that stagnant tax thresholds have severely eroded purchasing power amid inflation. The association’s position is that increasing take-home pay stimulates consumer spending, savings, and investment, which in turn supports economic growth, improves loan repayment rates, and can ultimately broaden the overall tax base over time.

High-income earners will also benefit, with the top marginal tax rate capped at 30 per cent, down from the existing range of 32.5 to 35 per cent. The government contends the policy is designed to boost disposable income for the middle class, spur domestic demand, and foster sustainable economic expansion.

The reforms will be formalised through the Tax Laws Amendment Bill, which is scheduled for parliamentary consideration before the release of the Finance Bill 2026 later this year. The legislative process will determine the final implementation timeline.

The move represents a pivotal shift in Kenya’s fiscal policy, directly targeting wage earners amid ongoing economic challenges. If passed, the changes are poised to alter the nation’s tax landscape and household finances significantly ahead of the 2026/27 fiscal year.