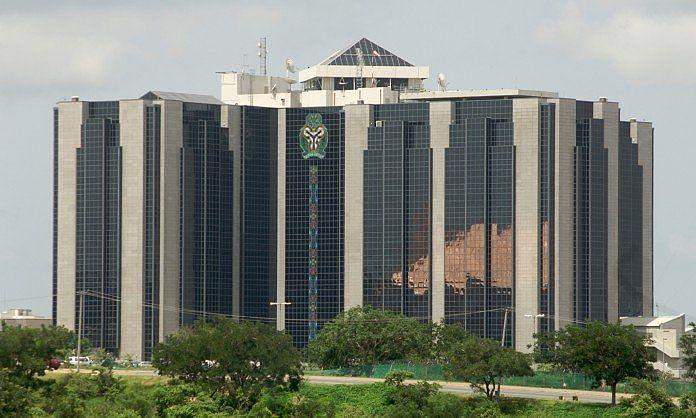

The Central Bank of Nigeria (CBN) has recently introduced a new guideline that places a limit on contactless payment in the country. This development was made public in two circulars signed by Musa Jimoh, the Director of the CBN’s Payments System Management Department.

According to the first circular, this guideline applies to banks, other financial institutions, and payments service providers who engage in contactless payment transactions. It aims to standardize operations in the payments system and promote the deployment of innovative products while ensuring the stability of the financial system.

Contactless payment refers to the process of conducting financial transactions without any physical contact between the payer and the acquiring devices. It has gained popularity as a safe and efficient method for low-value and large-volume payments.

The CBN’s guideline for contactless payments was developed to ensure that participants in this form of payment implement appropriate risk management processes and adhere to the highest relevant standards. It places an obligation on all banks, financial institutions, and payments service providers to strictly comply with the new guidelines.

By introducing this limit, the CBN is taking proactive measures to safeguard the financial system while encouraging the adoption of contactless payment options. With the increasing prevalence of digital transactions, it is essential to establish robust risk management processes to prevent fraud and protect consumers.

This move by the CBN is expected to have a significant impact on the Nigerian payments landscape. It will reinforce the trust and confidence of consumers in contactless payment methods and stimulate the growth of the digital economy.

As the implementation of the new guidelines begins, banks, financial institutions, and payments service providers are urged to ensure full compliance. Adhering to these standards will not only enhance the security of contactless payments but also contribute to the overall stability and development of Nigeria’s financial ecosystem.

In conclusion, the CBN’s decision to introduce a limit on contactless payments in Nigeria reflects its commitment to fostering a safe and efficient payments system. By implementing these guidelines, the CBN is setting the stage for the continued growth of contactless payments in the country, while ensuring the protection of consumers and the stability of the financial sector.