In response to the ongoing forex crisis, the Central Bank of Nigeria (CBN) has announced a series of operational changes for Bureau De Change (BDC) operations in the country. These measures, outlined on Friday, aim to curtail the activities of BDCs in Nigeria while enhancing efficiency in the foreign exchange market.

One significant change introduced is that BDC operators will now be required to buy and sell foreign currency within a permissible range of -2.5% to +2.5% of the Nigerian Foreign Exchange market window’s weighted average rate from the previous day. This adjustment aims to establish stability and transparency in exchange rate fluctuations, offering benefits to both BDC operators and the general public.

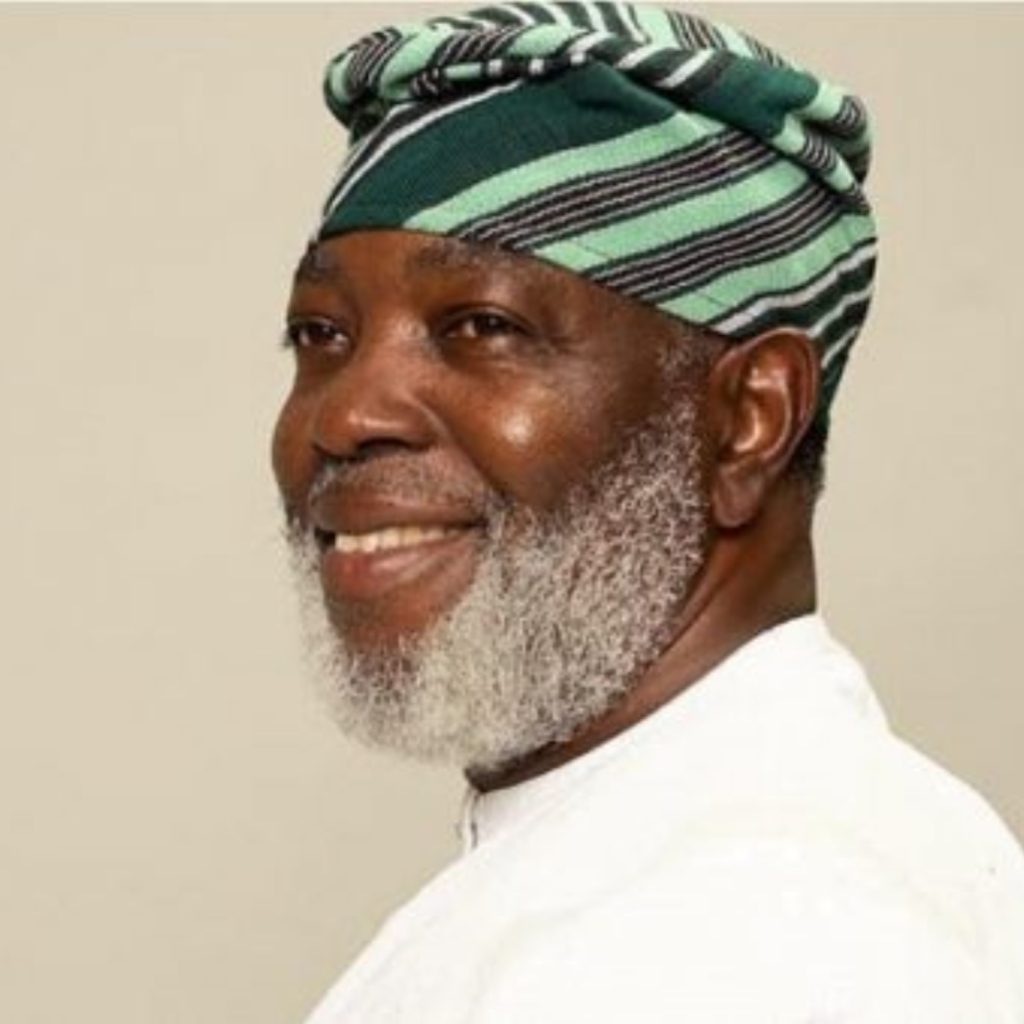

This development comes after the Acting Governor of CBN, Folashodun Shonubi, expressed concerns about forex speculators and vowed to introduce policies to curb their activities. The newly implemented guidelines are part of the regulator’s efforts to combat these speculative practices.