As the world teeters on the edge of a technological revolution, investment managers worldwide are divided on how these changes will impact global equity markets. This diversity of opinions highlights the importance of taking a broad-minded approach to investing in the years ahead. With technological disruptions and other innovations set to reshape the economic landscape, the stakes for investors have never been higher.

Understanding the Disruption

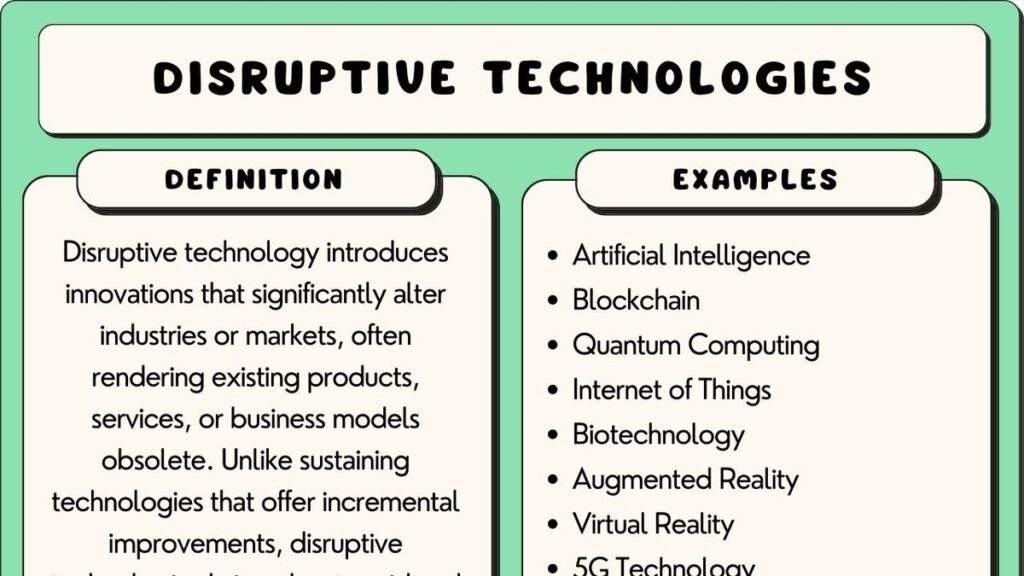

While technological advancements are nothing new in the global economy, the current pace and scale of innovation are unprecedented. From artificial intelligence (AI) to blockchain, these technologies are fundamentally changing how businesses operate and compete. Investment managers are closely monitoring these developments, as they recognize the potential for significant impacts on market dynamics and investment strategies. The differing perspectives among them arise from uncertainties about which technologies will prevail and how quickly industries will adapt.

Impact on Global Equity Markets

The impact of technological disruptions on global equity markets cannot be overstated. Some investment managers see these advancements as opportunities for substantial growth, especially in sectors leading the technological charge. However, there is also growing concern about the possibility of these technologies rendering existing business models obsolete, leading to market volatility and uncertainty. This dichotomy has resulted in a wide range of investment strategies, from aggressively pursuing tech stocks to cautiously diversifying across more traditional sectors.

Rethinking Investment Strategies

Given these developments, investors are advised to reconsider their investment strategies. Embracing a diversified approach that considers both disruption and growth potential appears wise. Additionally, staying informed about technological trends and their potential impact on various sectors will be crucial for navigating the evolving landscape. The differing opinions among investment managers underscore the complexity of predicting market movements and emphasize the importance of adaptability and informed decision-making in investment strategies.

As the dust settles on this period of disruption, global equity markets are likely to emerge transformed. The extent of this transformation, however, remains uncertain. What is evident is that the future of investing will increasingly depend on understanding and adapting to technological advancements. Those who can navigate this intricate terrain with insight and agility may find themselves at the forefront of the next wave of economic growth.