Central Bank of Nigeria’s New Directive Sparks Pushback from Oil and Gas Industry

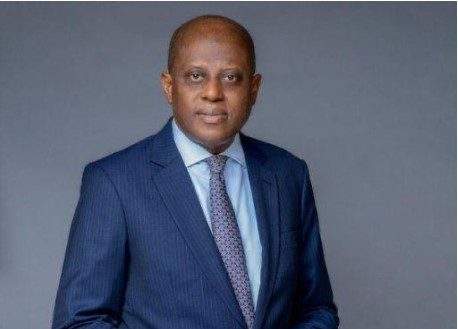

The Governor of the Central Bank of Nigeria, Dr. Olayemi Cardoso, has revealed that the apex bank faced resistance from players in the oil and gas industry when it issued a new directive on the use of foreign exchange proceeds by firms in the sector. Cardoso made the statement at the BusinessDay CEO forum themed ‘Leadership in Tough Economic Times’ held in Lagos.

The directive, issued in May 2024, allows oil firms to spend 50% of their repatriated export proceeds on financial obligations. The Central Bank of Nigeria (CBN) had earlier stopped international oil companies operating in Nigeria from immediately remitting 100% of their forex proceeds to their parent companies abroad. The regulator said that the practice known as ‘cash pooling’ had an impact on liquidity in the domestic forex market.

When asked about the impact of the directive, Cardoso said, “It is still work in process. To be frank, when this first came out, we got some pushback. But, we dialogued, spoke, looked at the issues that some of the players were uncomfortable with, and gave reassurances which seemed to calm many of them down and it works in process. I see that it is gradually getting to a phase where the sort of contributions that one would expect from that sector would be there.”

The CBN’s circular, signed by Director Hassan Mahmud, provided further clarifications on the directive. According to the circular, the initial 50% of the repatriated proceeds can be pooled immediately or as when required, and banks may submit requests for cash pooling ahead of the expected date of receipt, supported by required documentation, for approval by the CBN. The remaining 50% balance can be used to settle financial obligations in Nigeria, whenever required, during the prescribed 90-day period.

The eligible financial obligations for settlement include petroleum profit tax, royalty, domestic contractor invoices, cash calls, domestic loan principal and interest payment, transaction taxes, education tax, and forex sales at the Nigerian Foreign Exchange Market.

The CBN’s efforts to regulate the use of foreign exchange proceeds by oil firms aim to promote a more stable and liquid domestic forex market. The regulator’s pushback from industry players highlights the importance of effective communication and collaboration in implementing economic policies.