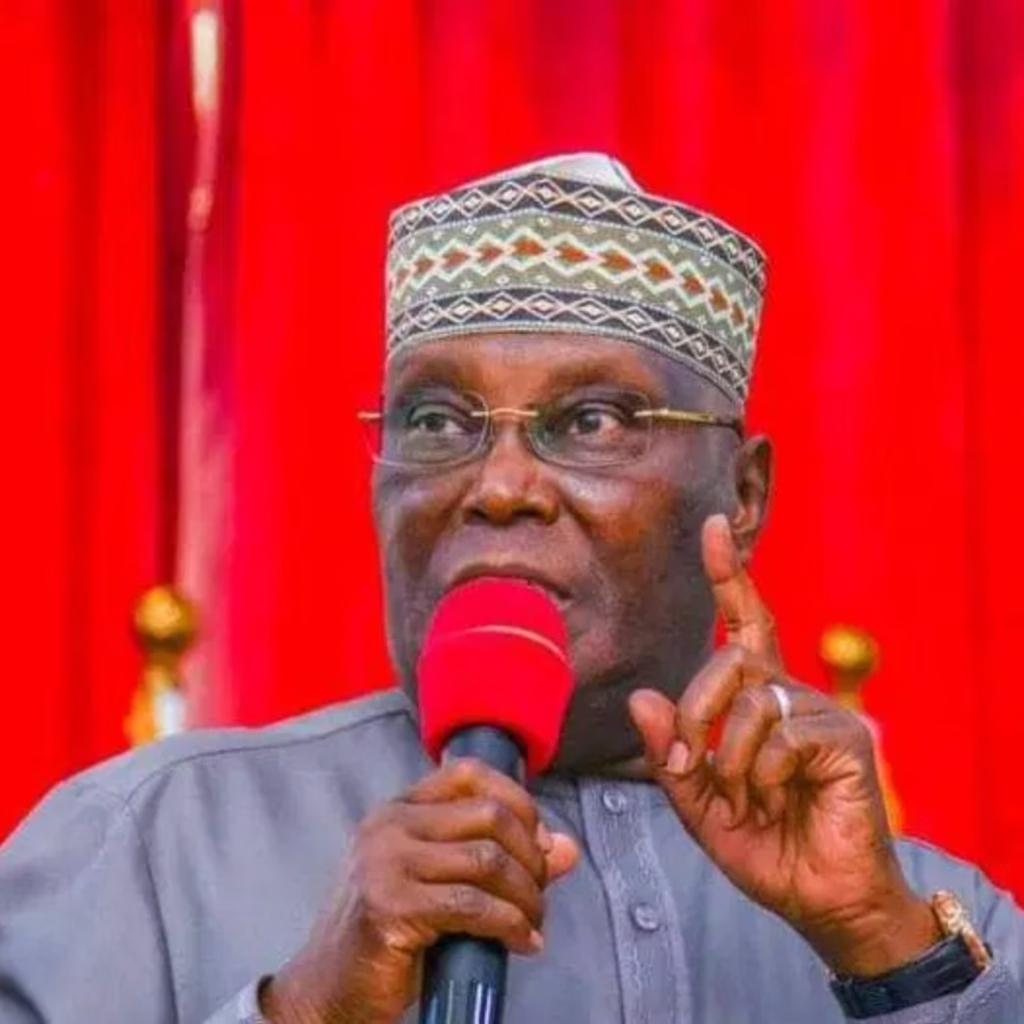

A storm is brewing in Nigeria’s political landscape as former Vice President Atiku Abubakar strongly criticizes the administration of President Bola Tinubu for seeking approximately $24.14 billion in foreign loans. This move has sparked widespread outrage among stakeholders, who fear that approving these loans could catapult Nigeria’s debt to a staggering N183 trillion.

President Tinubu’s request for the National Assembly’s approval for the loans earlier this week has ignited a firestorm of discontent. Atiku, in a statement released on Thursday, lambasted the All Progressives Congress (APC)-led government’s decision to pursue additional loans, describing it as “a reckless and dangerous move that threatens the future of Nigeria and generations yet unborn.” He emphasized that this decision comes at a time when Nigeria’s debt burden is already at alarming levels, standing at $94 billion and ₦144.7 trillion as of December 31, 2024.

The former Vice President pointed out that since President Tinubu took office in 2023, public debt has surged by 65.6%. Moreover, he highlighted that under the APC’s leadership since 2015, public debt has ballooned by a staggering 1,048%, from ₦12.6 trillion to ₦144.7 trillion. Atiku’s stern warning called for the immediate suspension of further borrowing by the current administration, underscoring the need for fiscal responsibility to safeguard the nation’s future.

The implications of such a significant increase in foreign loans are far-reaching and have raised concerns among Nigerians and international observers alike. The potential consequences of escalating debt levels on the country’s economy, its people, and future generations are daunting. As the debate unfolds, one thing is clear: the path forward for Nigeria’s economic and financial stability hangs in the balance, with the decision on these loans being a critical juncture in the nation’s history.