Former U.S. President Donald Trump has claimed that major financial institutions, including JPMorgan Chase and Bank of America, ceased handling his accounts following pressure from the Biden administration. The allegations, reported by the New York Post on Tuesday, cite anonymous banking and regulatory sources who say the White House sought to distance Trump from financial services after the January 6, 2021, Capitol riot.

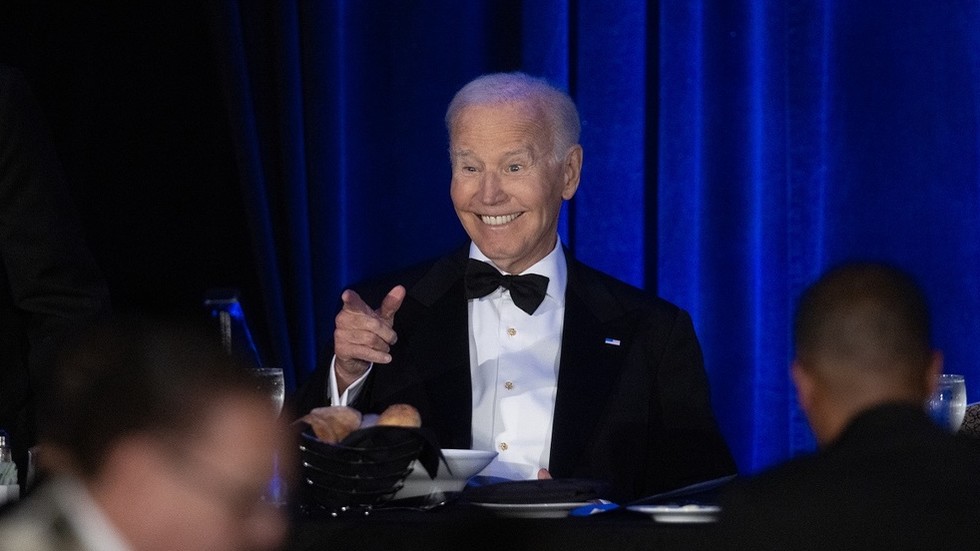

Speaking to CNBC earlier this week, Trump stated he was instructed by JPMorgan to withdraw hundreds of millions of dollars in assets, while Bank of America allegedly declined to accept the funds when he attempted to transfer them. Though he did not specify timelines, sources suggest these events occurred after he left office. The report links the banks’ decisions to regulatory scrutiny amid fallout from the Capitol breach, which unfolded as Congress certified President Joe Biden’s 2020 election victory. Trump has consistently denied wrongdoing, reiterating claims that the election was “stolen” through Democratic efforts.

An unnamed banking executive quoted by the Post described Trump as a “hot potato” for financial institutions after January 6, stating that regulators “made it clear we shouldn’t do business with him.” A JPMorgan official reportedly said federal authorities “put the fear of God in you” if institutions engaged with individuals tied to controversy. The U.S. Office of the Comptroller of the Currency and the Federal Reserve allegedly enforced guidelines requiring banks to assess reputational risks linked to clients, a policy critics argue has led to exclusion of conservative figures and cryptocurrency firms.

The financial sector’s relationship with political figures has drawn renewed attention as the Wall Street Journal revealed this week that Trump’s team drafted an executive order penalizing banks for “de-banking” clients based on political or social considerations. The order, which could be finalized imminently, seeks to counter practices perceived as discriminatory. While regulatory agencies have not directly commented on Trump’s claims, the Biden administration has previously emphasized enforcing anti-discrimination laws without targeting specific individuals.

The allegations highlight broader debates over corporate neutrality and the role of regulators in shaping financial access. Legal experts note that banks have wide discretion to drop clients deemed high-risk, though political motivations remain difficult to substantiate. The developments coincide with Trump’s ongoing legal challenges and campaign for the 2024 presidential election, where financial transparency and regulatory oversight are likely to remain contentious issues.