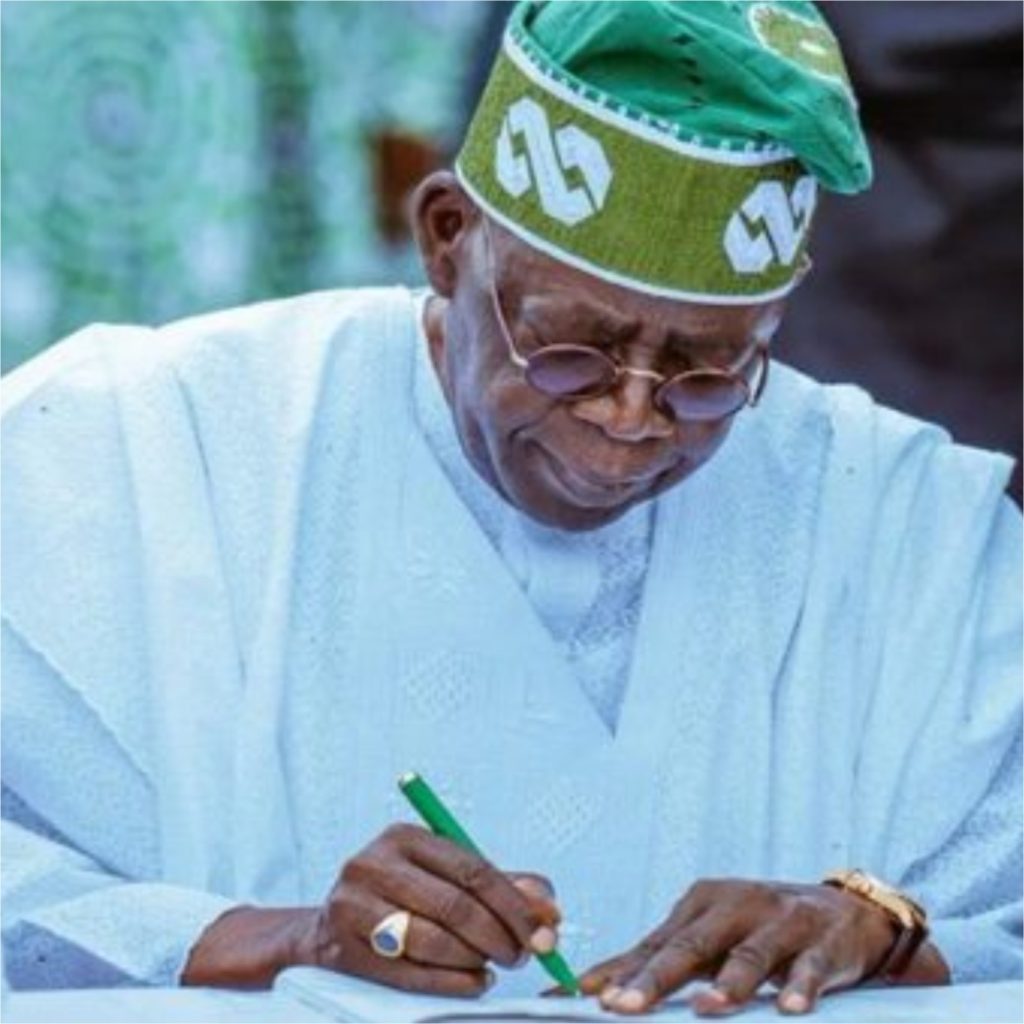

Nigeria has appointed its first Tax Ombudsman, John Nwabueze, following approval by President Bola Tinubu. The announcement was made by Bayo Onanuga, Special Adviser to the President on Information and Strategy, in a statement released in Abuja. This move is in accordance with the Joint Revenue Board of Nigeria (Establishment) Act, 2025, and aligns with the government’s broader objective to enhance accountability, fairness, and confidence in the country’s tax and revenue system.

Prior to his appointment, Nwabueze served as Managing Partner of a leading tax advisory firm. He also has experience working as Technical Adviser to the Joint Senate Committees on the Federal Capital Territory and Finance, as well as Technical Adviser to the Chief Economic Adviser to former President Olusegun Obasanjo. President Tinubu expressed confidence in Nwabueze’s ability to carry out his duties with integrity, diligence, and professionalism.

The Office of the Tax Ombudsman, established under the Act, provides an independent channel for taxpayers to resolve disputes with tax and revenue authorities. It will handle complaints related to taxes, levies, customs duties, excise, regulatory fees, and other fiscal matters. The office aims to offer a structured mechanism for fair and impartial dispute resolution, ensuring redress against arbitrary or abusive conduct by tax officials and improving efficiency in managing disputes.

The creation of the Tax Ombudsman is seen as a significant step towards strengthening taxpayer confidence, improving Nigeria’s tax culture, and supporting the administration’s efforts to expand revenue collection without imposing undue burden on citizens or businesses. By establishing this office, the government seeks to promote a more transparent and efficient tax system, which is essential for the country’s economic growth and development. With the appointment of Nwabueze as Tax Ombudsman, Nigeria is poised to make progress in enhancing its tax administration and fostering a more favorable business environment.