Approximately 20 million barrels of Nigerian oil for December and January loading remain unsold, according to a report by Reuters, citing two traders. This surplus is attributed to stiff competition from alternative supplies that are plentiful and cheaper. The unsold cargoes are a symptom of a broader oil market surplus, which has driven selling on the international futures market and pushed Brent crude below $60 per barrel to its lowest level since May.

Analysts note that the overhang of West African cargoes reflects the emerging global crude supply surplus in the first quarter. Victoria Grabenwoger of analytics firm Kpler stated, “The overhang of West African cargoes partly reflects the broader global crude supply surplus emerging in Q1.” Angola’s December-January programs also have several cargoes available, with estimates suggesting that both countries’ overhang could be as high as 40 million barrels.

The large amount of unsold oil is unusual, particularly for the current month, given that the West African trade cycle typically operates two months ahead. The slow start to the trading cycle for February cargoes can be attributed to the availability of these unsold cargoes, despite Angola’s loading schedule and term nominations already being released.

According to OilX analyst Francisco Gutierrez, the current market softness is partly seasonal and partly due to shifting buying patterns in response to freight costs and alternative supply options. He noted that Angolan January trade is 20% behind its long-term average pace, as China, the world’s largest commodities buyer, has switched to cheaper or nearer alternative grades.

Supplies from the Middle East are displacing medium and heavy West African grades in Asia, as lowered official selling prices in January and shorter voyages give those grades a competitive edge. Additionally, India’s oil imports from Russia have remained resilient despite tightening Western sanctions, displacing medium-heavy density West African crudes. Light to medium-density West African grades are struggling to compete with supplies from Argentina and Brazil.

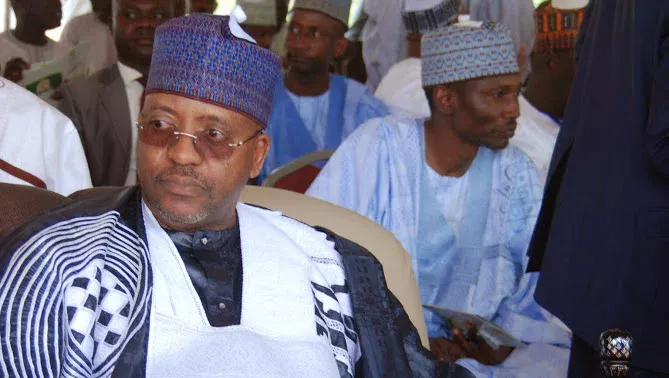

Nigeria is also facing challenges in marketing its oil due to reduced imports by the 650,000 barrels-per-day Dangote plant, which will undergo maintenance in January. The plant’s reduced imports have left Nigeria with more oil to market, exacerbating the surplus. As the global oil market continues to evolve, it remains to be seen how Nigeria and other West African countries will adapt to the changing landscape and find buyers for their unsold oil.