Gloria Essien, Abuja

Last updated Aug 25, 2023

The House of Representatives Committee investigating the non-remittance of funds to the National Housing Fund (NHF) and its non-utilization has summoned the Accountant General of the Federation. The purpose of the summons is to have the Accountant General explain why monies deducted from workers’ salaries are not being remitted to the NHF.

This development follows a disclosure made to the committee by a representative of the Director of the Integrated Personnel Payroll and Information System (IPPIS), Mr. Ekwem Dem. He stated that while deductions from workers’ salaries were automatic, remittances to the NHF were not automated.

However, when asked about the amount deducted as Housing Fund from workers since 2011, Mr. Dem could not provide an immediate response. He mentioned that although they have the information, he needs to “query the system” before providing an accurate answer.

Upon reviewing documents presented by the IPPIS, the committee members observed that the University of Calabar had deducted N23000 for NHF for one month, while the Federal Polytechnic, Birnin Kebbi contributed N9000.

In light of this discovery, the committee urged the Accountant General to furnish them with information on the total deductions made from workers, when these deductions were made, and why the money has not been remitted.

Hon. Timehin Adelegbe, a member of the committee, emphasized that if the deduction process is automated, the remittances should be automated as well.

Additionally, the committee instructed the Accountant General to remit all deductions to the Federal Mortgage Bank immediately and to present the receipt of remittance to the committee.

The Accountant General is also required to clarify the disparities in deductions from workers across various government agencies. The committee further seeks an explanation as to why only N20 billion has been remitted to the Federal Mortgage Bank since 2011.

Act Amendment

Meanwhile, Mr. Madu Hamman, the Managing Director of the Federal Mortgage Bank of Nigeria (FMBN), appealed to the committee to amend the act that establishes the Bank and the National Housing Fund. He believes that such an amendment would enhance the operation of the NHF.

Mr. Hamman stated that the Bank has collected approximately N591.523 billion in remittances from both the formal and informal sectors of the Nigerian economy since 2011. Out of this total, N238.557 billion was collected from government Ministries, Departments, and Agencies.

Moreover, he revealed that the bank has an outstanding payment of approximately N26.573 billion with the office of the Accountant General of the Federation.

Breaking down the outstanding payment, Mr. Hamman explained that the Accountant General erroneously deducted about N11.6 billion from the bank’s remittances between October and December 2022. This deduction was mistakenly treated as government revenue instead of workers’ contributions to the NHF. The deduction ceased following the implementation of the Treasury Single Account.

Furthermore, Mr. Hamman disclosed that the IPPIS failed to remit approximately N11.587 billion deducted from workers’ salaries between January and December 2022, as well as N3.356 billion between April and July 2021.

He also highlighted that contributors to the National Housing Fund are eligible for a full refund of their contributions with a 2 percent accrued interest upon retirement at the age of 60, incapacitation, or death.

To date, the Bank has refunded N66.678 billion to 444,637 individuals. Out of the total N591.523 billion collected for the National Housing Fund, approximately N347.570 billion has been invested in various projects financed by the Bank. These include Cooperative Housing Development Loan, NHF Mortgage Loan, Ministerial Pilot Housing Scheme, TUC/NLC/NECA Housing Scheme, Individual Construction Loan, Home Renovation Loan, and Rent to Own.

Mr. Hamman also pointed out some major challenges, including the concentration of Primary Mortgage Banks (PMBs) in Lagos and Abuja, with a lack of PMBs in most states of the Federation. He mentioned that only 34 PMBs currently exist in the country.

Additionally, he referenced the contradictions between the FMBN act and the CBN prudent guideline on single obligation limits for PMBs as a factor affecting loan disbursement. Furthermore, the low income of the majority of contributors has resulted in a lack of loan affordability.

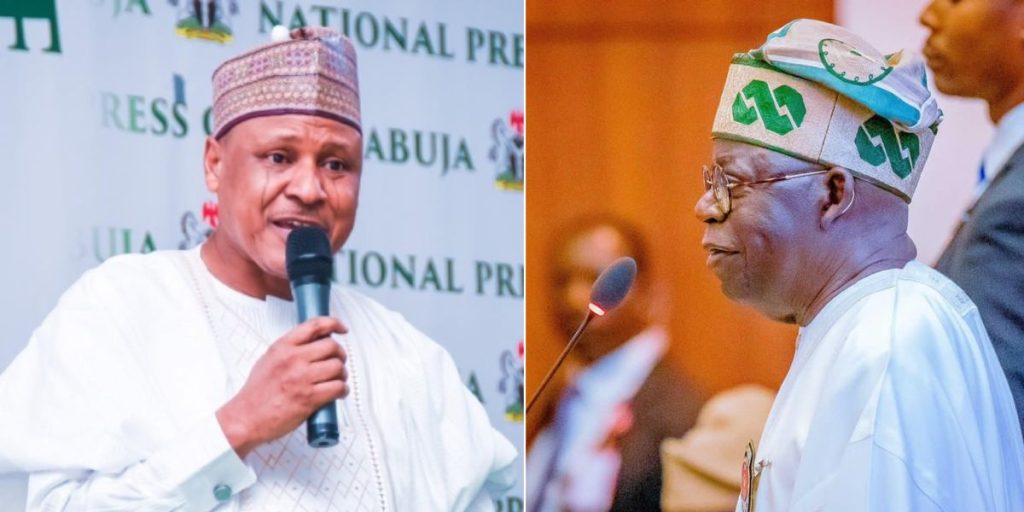

Hon. Datchung Bagos, the Chairman of the Committee, stated that their objective is to uncover the truth through engaging with stakeholders. He emphasized that the hearing aims to address the housing needs of Nigerian workers.